They will take the economy down if they have to so prices will stop rising. They want people to lose their jobs and make less money.

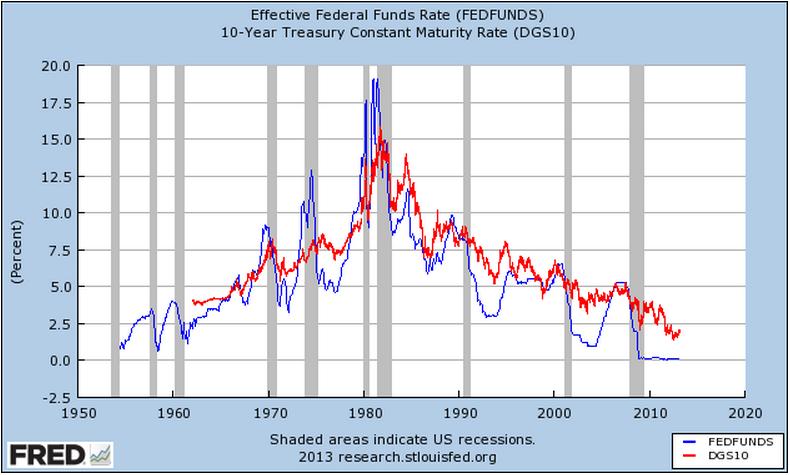

It took them a while to get going but once they realized inflation was an actual problem they’ve now overcorrected and raised rates at a faster clip than just about every Federal Reserve in history. Kathy Jones from Charles Schwab looked at the change in Fed Funds Rate during the last 40 years or so of tightening cycles:

It was supposed to be transitory and it wasn’t.īut the Fed has already moved ridiculously fast with their tightening. The Fed was behind the eightball in terms of seeing this inflation coming.

#If the fed wants to lower the federal funds rate it can free

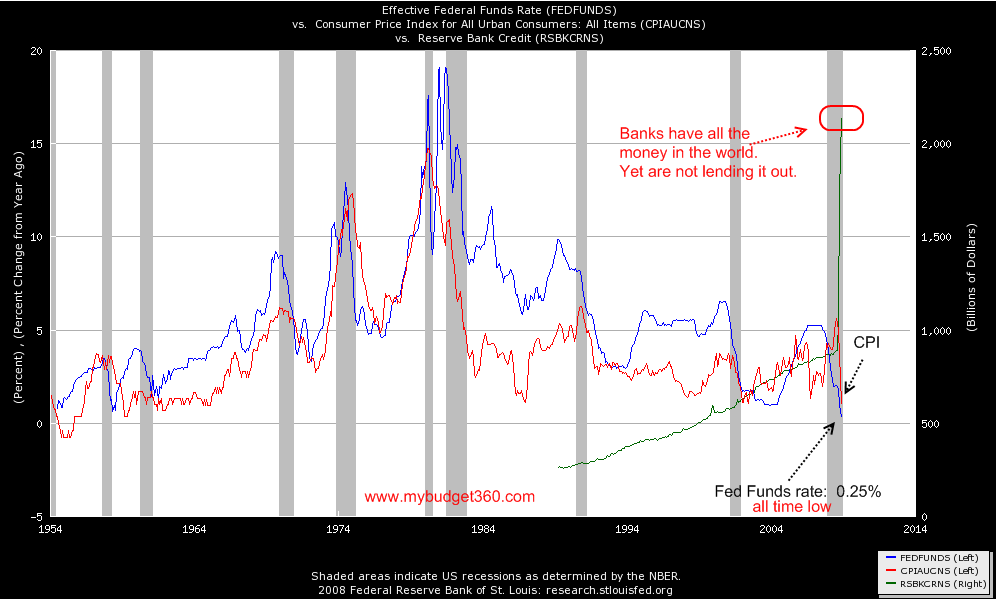

I appreciate how the Fed must feel somewhat responsible for the highest inflation reading in 40 some odd years because they kept rates at 0% for a long time and gobbled up bonds like people at Costco eating free samples. They cannot control the actions of a madman in Russia who continues to fight a cruel war against an innocent nation. They don’t dictate how the different waves of Covid will impact the global economy. The Fed was responsible for some of those problems but there were also extenuating circumstances. The pandemic seriously messed up the economy and markets in a multitude of ways. People REALLY don’t like sky-high inflation.īut in other ways, I think what the Fed is doing is INSANE. In some ways, I understand why the Fed is so hell-bent on slowing rising prices.

We’re never going to say that are too many people working, but the real point is this, inflation, what we hear from people when we meet with them is that they really are suffering from inflation. In fact, this week Fed chair Jerome Powell basically said people need to lose their job to slow inflation: The Fed is actively trying to crash the stock market, break the housing market and push the economy into a recession.īecause Fed officials are literally telling us this every time they speak. If anything, it feels like the Fed wants to fight us, all of us, including the stock market and the economy. Don’t fight the Fed used to be a positive slogan.

0 kommentar(er)

0 kommentar(er)